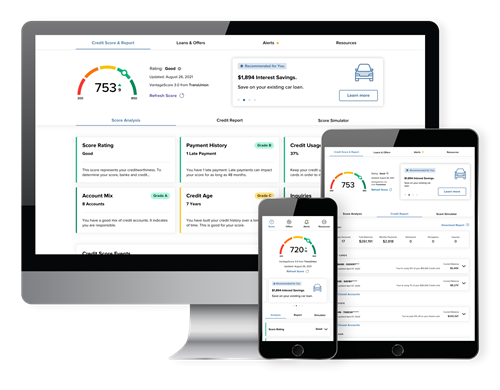

Credit Score by SavvyMoney

Credit Score by SavvyMoney is a valuable guide to help you on your financial journey.

This comprehensive credit score program, offered by True North at no cost to you, gives you the power to stay on top of your credit.

- Free access to your credit score and full credit report.

- You can track your credit score daily (up to every 24 hours) -- your score will never be negatively affected.

- To start a dispute or place a freeze on your credit, click here.

- Use the Score Simulator to see what happens to your score if you were to take certain actions.

- No extra apps to install or additional tools to learn, it's all right within your eBanking desktop or True North Mobile app.

With this tool, you can also:

- See how True North can help you reduce your rate or monthly payments on your debt.

- Set up Alerts to stay informed about what's happening to your credit history.

- Access quick and meaningful information to help you on your financial journey.

Try out Credit Score today!

You can easily access Credit Score through our eBanking and True North Mobile App by clicking on the Credit Score widget on your dashboard or the :: More menu.

.

.

.

.

.

.

.